Social security claiming strategies for married couples calculator

This calculator analyzes the multiple Social Security retirement benefit scenarios available to a married couple both spouses must be age 50 or older. Calculate Then Claim You dont have to guess when it comes time to determine the best time to take your Social Security benefits.

Social Security Strategies For Married Couples

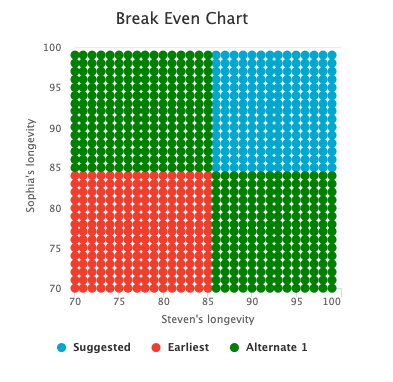

Given the assumed ages at death the.

. Social Security Retirement Benefits and Related Planning Topics Explained in 100 Pages or Less. Get 3900 a month for four years and then 6032 thereafter. Social Security Strategies for Married Couples.

You can compare how much you will receive at various. The tool provides a benefit estimate for three claiming ages. Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points.

For 500000 portfolios download the guide Maximize Your Social Security for Retirement. The AARP Social Security Benefits Calculator allows you to input income for both you and a spouse at the same time. Financial Engines Social Security Retirement Calculator estimates Social Security benefits and produces claiming strategies for 1 a single person eligible for earned benefits only 2 a.

Given the assumed ages at death the. Once you input your data and choose your options youll receive a detailed report. A The 6670 strategy.

Get nothing for four years and then 6864 thereafter. The most important thing for couples is to have a plan when it comes to Social Security claiming. The following is an adapted excerpt from my book Social Security Made Simple.

B The 7070 strategy. Pick a strategy that plays out well regardless of where the longevity cards. You can play What-if simulations with future income and select.

For example if a couple is married for 10 years or more and then decides to part ways each spouse is entitled to a certain percentage of the Social. Social Security will calculate your own retirement benefit based on your 35 highest-earning years and then calculate your spousal benefit based on your partners 35. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad Deciding When To Claim Your Social Security Benefits Can Be Tricky. Online Social Security calculators will do. Once her husband claims his Social Security the excess spousal amount of 400 would be added to her permanently reduced benefit of 750 for a total new benefit of 1150.

This calculator analyzes the multiple Social Security retirement benefit scenarios available to a married couple both spouses must be age 50 or older. Ad Learn how Social Security works estimate benefits and when you should start collecting. It will provide tables so you can compare your choices month-by-month or year-by-year.

Finding an optimum Social Security claiming strategy is hard enough for a single person but even more difficult for a. Age 62 your full retirement age and age 70. Have the higher earner claim Social Security early.

Build Your Future With a Firm that has 85 Years of Investment Experience. That guarantees the surviving spouse a higher Social Security check for life. Spouses even those who never worked may claim a Social Security retirement benefit based.

If youre retiring early but will need a hefty Social Security payday to keep up with your.

Comparing Two Common Social Security Claiming Strategies For Married Couples Bogleheads Org

Why It Rarely Pays For Both Spouses To Delay Social Security Breakeven

When To Claim Social Security Calculators

Social Security Tips For Married Couples Vanguard

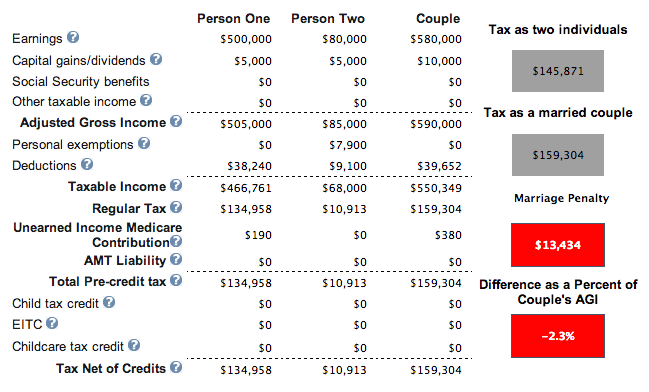

What Are Marriage Penalties And Bonuses Tax Policy Center

Social Security Tips For Married Couples Vanguard

Social Security Tips For Married Couples Vanguard

Insurance Facts And Statistics For Married Couples Bankrate

How Does The Social Security Timing Break Even Chart Work

Social Security Tips For Married Couples Vanguard

At What Income Level Does The Marriage Penalty Tax Kick In

Can A Married Couple Collect Two Social Security Checks As Usa

Social Security Tips For Married Couples Vanguard

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

3 Social Security Strategies For Married Couples Retiring Early The Motley Fool

Social Security Strategies For Married Couples Oblivious Investor

Social Security Tips For Married Couples Vanguard